The future of KYC Compliance.

Powered by IDToday.

IDToday enhances your Know Your Customer (KYC) procedures, offering efficiency and cost-effectiveness while bolstering compliance standards.

Industry leaders trust IDToday to streamline processes, improve data quality, and enrich client experiences.

Designed by Experts, for Compliance Leaders

Our solutions, developed with industry experts, helps compliance leaders confidently and easily manage regulatory complexities.

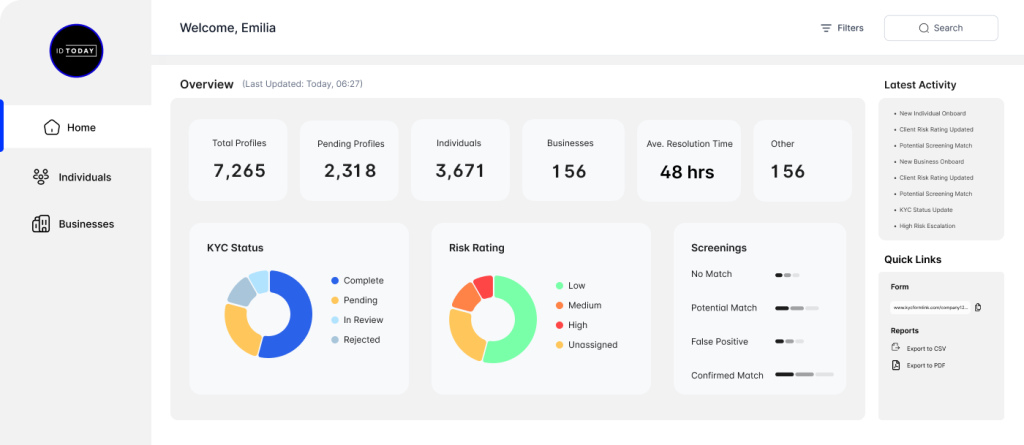

Compliance Dashboard

Our flagship KYC software offers an end-to-end workflow solution, integrating expert-vetted forms, automated risk screenings, and analytics to streamline client onboarding and ensure compliance with a robust audit trail and seamless system integrations.

Expert Vetted KYC Digital Forms

Designed by compliance experts, our forms ensure accuracy and efficiency, enabling a smooth verification process that enhances user experience.

Automated Screenings

Our algorithms, powered by Dow Jones Risk & Compliance, quickly screen against 50+ sanctions lists for swift compliance and reduced risk.

Risk Rating Module

Our system helps you analyse multiple data points to assign accurate risk ratings, helping you make informed decisions with confidence.

Analytics

Track client KYC status, flag unusual patterns, and maintain compliance with an intuitive overview that highlights essential KYC metrics.

Audit Trail

Our robust audit trail ensures transparency and accountability by logging every action with timestamps for clear audit and regulatory records.

Integrations

Connect with your existing systems. our platform enhances workflow and data management across diverse software.

Risk & Compliance Screening Portal

Our self-service platform delivers our premier screening tools to you as a standalone module. Simplify risk and compliance screenings by leveraging automation, world class coverage, improving compliance, efficiency and accuracy all at the same time.

Automated Screenings

Our automated screening process instantly identifies and flags risks, providing real-time updates and alerts, ensuring seamless compliance with no manual re-screening needed.

Extensive Coverage Lists

Leverage our Dow Jones-powered screening to ensure compliance and mitigate risk by checking financial instruments against 50+ sanctions lists and proprietary data.

Ongoing Monitoring & Nofitications

Stay ahead with our real-time monitoring and alerts, ensuring you’re always updated and compliant with the latest sanctions and risk data.

Detailed Match Analysis

Our in-depth results provide comprehensive details on potential matches, enabling quick identification of confirmed risks as well as efficient resolution of false positives.

Tailored Solutions

In addition to our product offerings, we provide tailored solutions designed to adapt to your specific business requirements, ensuring a seamless integration with your existing systems and processes for optimized performance and efficiency.

Independent KYC Audit

To bolster your adherence to Article 39 (8) of the Financial Intelligence Act, IDToday can assist with comprehensive annual audits and preparation for FIC inspections.

FIA & KYC Training

IDToday offers training for your team on detecting and managing suspected money laundering and terrorism financing, in line with Article 39 (9) requirements.

Tailored Risk & Compliance Program

Our team of experts will assist you to prepare a risk and compliance program in line with the Financial Intelligence Act that is specific to your business and industry.

Workflow Management

Streamline business processes, enabling efficient task allocation and progress tracking. Automate routine tasks, facilitate collaboration and use insights for better decision-making.

Smart Risk Assessment

Enhance and automate your Risk Rating Process with IDToday’s advanced module, designed to tailor risk assessment to your specific needs.

Biometrics & Liveness

Harnesses the power of unique physical traits, like facial patterns, for identity verification. This solution adds a critical layer of security, ensuring that interactions are with real, verified users.

Don't just take our word for it

Want to learn more?

Take the first step towards streamlining your compliance processes with IDToday.

Contact us now to schedule a consultation and learn more about how we can help your business.